Standby Letter of Credit (SBLC) mt760 Provider with Prime Banks

A Standby Letter of Credit (SBLC) is a powerful financial instrument that serves as a guarantee of payment to a beneficiary in the event that the applicant fails to fulfill their contractual obligations. Unlike traditional letters of credit used in trade finance, SBLCs primarily function as a backup payment mechanism, providing assurance to the beneficiary that they will receive payment as stipulated in the agreement.

Why Choose Our SBLC Services?

Trusted Partner in Financial Security

At Chandra Credit Ltd, we pride ourselves on being a trusted partner in safeguarding your financial interests. With years of experience in handling SBLC transactions, we offer unparalleled expertise and dedication to ensuring the security and reliability of your financial dealings. Chandra Credit Ltd offers Standby Letter of Credit services that can provide a financial guarantee to a beneficiary on behalf of a client. This service can be used as a form of payment security in various industries, including international trade, real estate, and construction. With Chandra Credit Ltd's Standby Letter of Credit services, clients can have peace of mind knowing that their transactions are protected and their financial obligations are fulfilled.

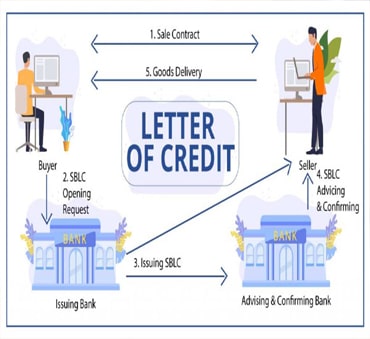

How Does SBLC Work?

SBLCs operate on the principle of financial assurance, offering a safety net for parties involved in various transactions. When an Standby letter of Credit is issued, the issuing bank commits to making payment to the beneficiary if the applicant defaults or fails to meet their obligations. This commitment serves as a valuable risk mitigation tool, instilling confidence and facilitating smoother business transactions.

Services offer by Us

We as financial consultant in Noida offer these services

Trade Finance

Project Finance

Private Equity

Business Advisory

Documents Required for Standby Letter of Credit (SBLC):

These are the documents required for Standby LC

- Application: The applicant needs to submit a formal application requesting the issuance of an SBLC. This application includes details such as the amount, purpose, terms, and conditions of the SBLC.

- Financial Information: The bank typically requires the applicant to provide financial statements, bank statements, and other supporting documents to assess their creditworthiness and ability to fulfil the obligations under the SBLC.

- Collateral: Depending on the bank's policy, collateral may be required to secure the SBLC. This could include cash, certificates of deposit, or other acceptable forms of collateral.

Types of Standby Letter of Credit (SBLC):

These are the different types of Stand by letter of Credit

- Financial SBLC: This type of SBLC is primarily used to support financial obligations, such as loan repayments or bonds.

- Performance SBLC: Performance SBLCs are issued to ensure the completion of a project or the performance of specific contractual obligations.

- Bid Bond or Tender SBLC: This type of SBLC is used in the bidding process for contracts. It assures the recipient that the bidder has the financial capability to fulfill the contract if awarded.

Our Achievements

How to Apply for an SBLC? follow these general steps:

- Hire Financial Consultant: Chandra Credit is a business organization that helps you achieve the dream of growing your business. With experience of more than 20 years, Chandra Credit is a top leading entity which provide every aid needed in setting up and taking the business to new heights. Feel free to contact for any assistance.

- Identify a Bank: Find a reputable bank that offers SBLC services and is willing to issue the SBLC on your behalf. It's advisable to consult with multiple banks to compare terms, conditions, and costs.

- Submit Application: Complete the application form provided by the bank. Include all the necessary details, such as the purpose, amount, terms, and conditions of the SBLC.

- Provide Required Documents: Prepare and submit the required documents, such as financial statements, bank statements, and collateral, as per the bank's requirements.

- Negotiate Terms: Discuss and negotiate the terms and conditions of the SBLC with the bank, including fees, expiry date, and any specific requirements.

- Pay Fees and Charges: Once the terms are agreed upon, pay the required fees and charges associated with the SBLC. These may include an issuance fee, administrative charges, and any collateral requirements.

- Issuance and Delivery: Upon receipt of payment and completion of the necessary documentation, the bank will issue the SBLC. It will then be delivered to the beneficiary, who can rely on it as a form of payment guarantee.

SBLC Cost and thing to Remember

The cost of an SBLC can vary depending on several factors, including the issuing bank, the amount, the duration, and the applicant's creditworthiness. Typically, the bank charges a fee, which is a percentage of the SBLC amount, along with any associated administrative costs. The exact cost can be negotiated with the bank issuing the SBLC.

Remember, the specific process and requirements may vary between banks and jurisdictions. It's essential to consult with the issuing bank directly to get accurate and up-to-date information for your specific situation.

Grow Your Business

With Us

Chandra Credit is a business organization that helps you achieve the dream of growing your business. With experience of more than 20 years, Chandra Credit is a top leading entity which provide every aid needed in setting up and taking the business to new heights. Feel Free to contact for any assistance.

Contact Us

Get In Touch

Quick Contact

APPLICATION FORM AWAITS HERE

However, if you're looking to download the application form from the website.

Download NowWe are Here to Help You

Email Us

Call us at

Contact Info

9th floor office No - 923, Tower C,b-8,

Sector -62,Gautam Budh Nagar, (Up), India,

Pin 201309